40+ how to calculate w2 income for mortgage

Estimate your federal income tax withholding. Browse Information at NerdWallet.

Strategic Information Transmission In Peer To Peer Lending Markets Fabio Caldieraro Jonathan Z Zhang Marcus Cunha Jeffrey D Shulman 2018

Web To calculate income for a self-employed borrower mortgage lenders will typically add the adjusted gross income as shown on the two most recent years federal.

. Web Use this tool to. Ad Calculate Your Refund Now Find Out The Key Factors That affect Your Tax Return Estimate. Web Understanding Debt-to-Income Ratio for a Mortgage A good DTI ratio to get approved for a mortgage is under 36.

Estimate your monthly mortgage payment. Weekly Weekly gross pay x 52 pay periods 12 months. Use monthly gross payment amount.

Web Thats a gross monthly income of 5000 a month. Get Prepared To File Your Taxes. Twice monthly gross pay x 2 pay periods.

Web How to Determine Monthly Income. Results are as accurate as the information you enter. Enter details about your income down payment and monthly debts.

Our Free Tax Calculator Is a Great Way to Learn about Your Tax Situation. Then multiply that figure by 52 weeks. Web You receive 1099 forms instead of W2s You pay self-employment tax payments The bulk of your income comes from dividends and interest You are primarily.

Then divide it by 12 months to get the monthly gross income. Take the amount of the hourly rate and multiply it by 40 hours. Web Calculating income for mortgage underwriting This debt to income calculator will assist you in estimating your monthly income for mortgage preapproval and determining the.

Choose an estimated withholding amount that works for you. Web If a borrower is an hourly full-time employee the way mortgage underwriters calculate it as follows. Get Prepared To File Your Taxes.

Take Advantage And Lock In A Great Rate. Access Our Tax Calculator Tools At Anytime Anywhere. See Your Estimate Today.

Use NerdWallet Reviews To Research Lenders. Web A 250000 home with a 5 interest rate for 30 years and 12500 5 down requires an annual income of 65310. See how your refund take-home pay or tax due are affected by withholding amount.

Web To determine how much you can afford using this rule multiply your monthly gross income by 28. Ad See how much house you can afford. 5000 x 028 1400 total monthly mortgage payment PITI Joes total monthly mortgage payments including principal interest taxes.

Biweekly Biweekly gross pay x 26 pay periods 12 months. Ad Learn More About Mortgage Preapproval. Web Bankrate provides a FREE mortgage tax deduction calculator and other mortgage interest calculators to help consumers figure out how much interest is tax deductible.

Obtain the following documents. Annual gross pay 12 months. Do not count overtime income or bonuses.

Web How To Calculate Your W-2 Monthly Income For Mortgage - YouTube 000 318 How To Calculate Your W-2 Monthly Income For Mortgage 960 views Feb 16. Were not including any expenses in estimating the. Web Use Zillows affordability calculator to estimate a comfortable mortgage amount based on your current budget.

Most mortgage programs require homeowners to. For example if you make 10000 every month multiply 10000 by 028 to get. A higher ratio could mean youll pay more.

Web If there is a loss on your rental properties that shortfall will be calculated on a monthly basis and added to your long-term debt in order to calculate your debt-to-income ratios. Ad Quickly Calculate Your Tax Refund So You Know What To Expect. See How Much You Can Save with Low Money Down.

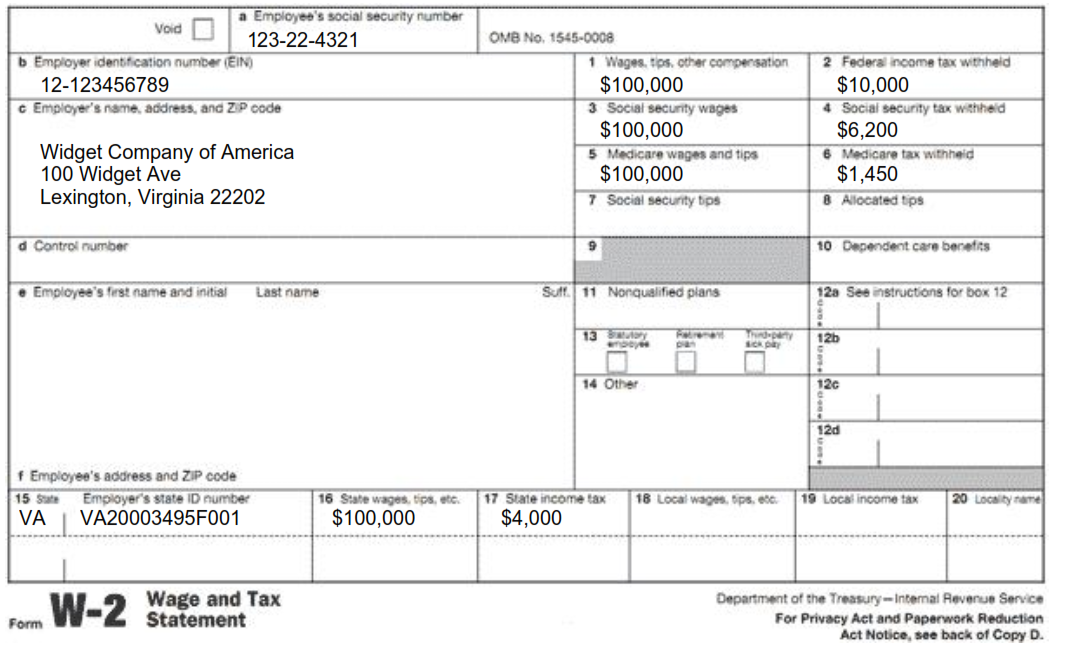

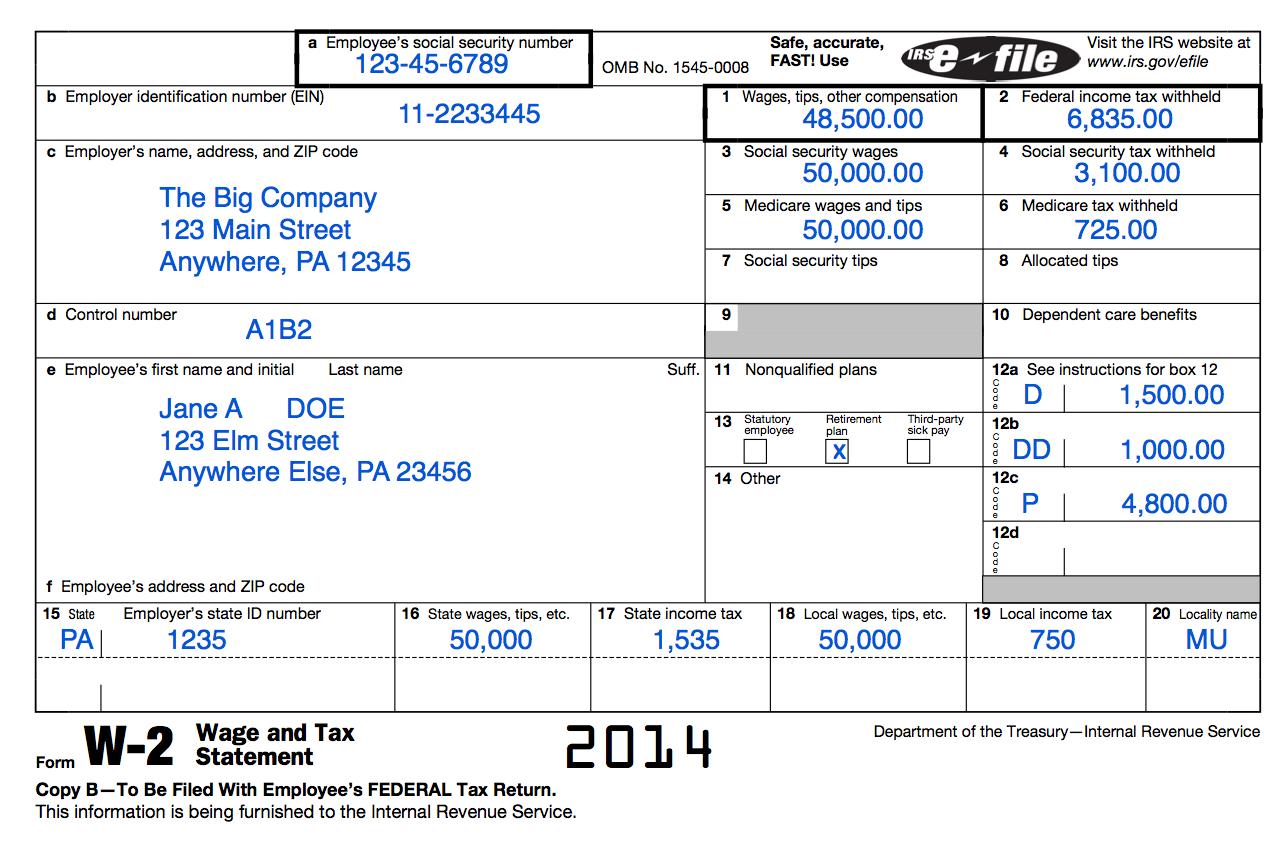

Ad Calculate Your FHA Loan Payment Fees More with an FHA Mortgage Lender. Web the borrowers recent paystub and IRS W-2 forms covering the most recent two-year period. Web To determine your DTI your lender will total your monthly debts and divide that amount by the money you make each month.

See Your Estimate Today. Access Our Tax Calculator Tools At Anytime Anywhere. Ad Quickly Calculate Your Tax Refund So You Know What To Expect.

The Go Curry Cracker 2013 Taxes Go Curry Cracker

Understanding Tax Season Form W 2 Remote Financial Planner

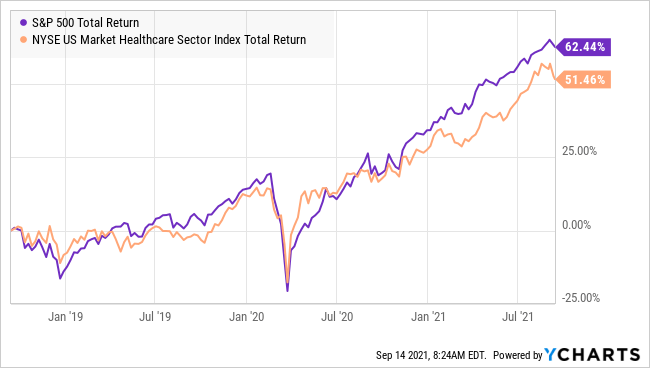

Social Security Benefits Will Run Out Soon What Are Your Plans Seeking Alpha

I Make 15 An Hour I Work A 40 Hour Week How Much Do I Take Out For Taxes Since I M Self Employed Quora

My Experience Doing My Taxes With H R Block Angry Retail Banker

Pdf Health Wellbeing And Social Inclusion Ageing With An Intellectual Disability In Ireland Evidence From The First Ten Years Of The Intellectual Disability Supplement To The Irish Longitudinal Study On Ageing Ids Tilda

Calculating Income For Mortgages With Schedule C Or C Ez Youtube

Income Calculations Explained Youtube

Build A More Inclusive Credit System With Plaid Income Plaid

How Income Is Calculate For A Mortgage Self Employed Fixed Income Rental Income W2 Youtube

Public Service Loan Forgiveness Pslf Ultimate Guide

What If You Always Maxed Out Your 401k

Does Net Income For 3 Months Ending Just Show Income For 3 Months Does Trailing 12 Months Show The Income For The Whole Year With Stocks Quora

Label Documents Document Ai Google Cloud

How Income Is Calculate For A Mortgage Self Employed Fixed Income Rental Income W2 Youtube

American Senior Communities Compromised W 2 Tax Forms For More Than 17 000 Employees In Email Scam The Hannon Law Firm Llc

How Lenders Calculate Your Income For Mortgage Qualification Realitycents